Elizabeth Holmes, the founder and 50% owner of Theranos, the healthcare technology start-up that is now defunct, is standing trial on investment fraud charges for millions of dollars.

The trial of the US versus Elizabeth Holmes, et al will be closely watched and started on 31 August 2021. Holmes faces 12 charges of fraud, which involves allegedly defrauded investments of more than $150 million. She may face up to 20 years in prison if found guilty.

Although Holmes has pleaded not guilty to the charges, the trial has reignited the debate on the high-risk healthcare technology sector. Andy Jacob, CEO of DotCom Magazine says, “While we don’t know the outcome of the trial yet, it is not going to really hurt the healthcare technology space. It will actually make it better as investors will flock to only the most solid of solid start-ups, which will make the entire space more productive and more powerful in terms of making people health better.”

How did Elizabeth Holmes fall so far?

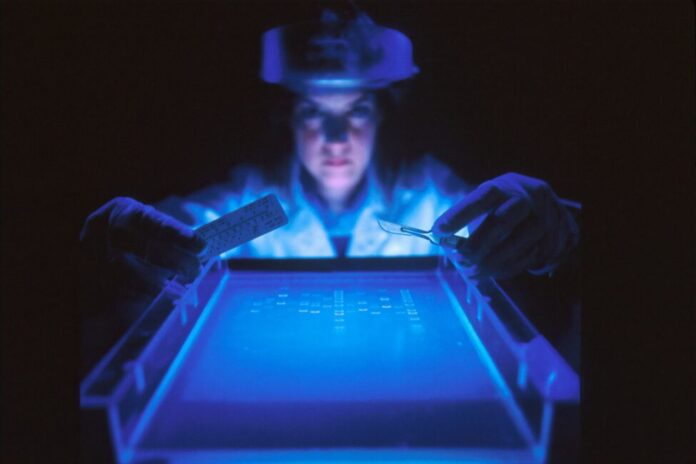

Holmes dropped out of Stanford University at age 19 in 2003 and founded Theranos, a diagnostic service start-up. The company was only launched officially 10 years later. Holmes marketed Theranos’ blood-test technology on reports that it was able to provide an accurate and fast diagnosis by using only a few drops of blood. Comparable conventional tests at the time required vials of blood.

In 2015, Forbes magazine estimated Holmes’ worth of $4.5 billion. A report published in the Wall Street Journal in October 2015 questioned Theranos’ technology for blood testing and claimed that most of the blood tests performed for various conditions that ranged from cancer to cholesterol were done with the conventional method of using a vial of blood rather than a few drops.

The Centers for Medicare and Medicaid Services (CMS), the Federal regulator, cautioned Theranos in 2016 and accused the laboratory of not complying with federal standards. The CMS gave Theranos 10 days to resolve the issue. The CMS subsequently revoked Theranos’ laboratory license in California in July 2016 and banned Holmes for two years from operating a blood-testing laboratory.

Theranos’ investor, Partner Fund Management, accused the company in October 2016 of securities fraud and sued for $96.1 million. Also in 2016, Theranos’ retail partnership with Walgreens, America’s second-biggest pharmacy store chain, ended and the firm in November 2016 sued Theranos for $140 million for breach of contract. In 2017, Theranos settled with both firms.

The US SEC (Securities and Exchange Commission) charged the former president of Theranos, Ramesh Balwani, and Holmes in March 2018 with allegedly raising more than $700 million from investors through fraud in which they made false statements or exaggerated about various aspects of the company.

If found guilty, Holmes would be stripped of control of the company, would have to return millions of shares, and will be barred for 10 years from serving as a director officer of a public company.

The Theranos scandal

Elizabeth Holmes and Theranos’ president, Ramesh Balwani, allegedly falsely claimed that the company’s “minilab” or “Edison” could use a few drops of blood from a finger prick to provide fast, accurate, cheap, and reliable blood tests. Although the device was marketed as revolutionary, it is alleged that the tech had reliability and accuracy problems, and was slower than other conventional devices.

It is also alleged that Holmes and Balwani made numerous false representations to investors that the company would generate more than $100 million in revenues and break even in 2014, and that revenue in 2015 would be about $1 billion. It is alleged that both knew the firm would only generate modest revenues in 2014 and 2015.

Although both stated that Theranos’ products were used on medevac helicopters and Afghanistan’s battlefield by the US Department of Defense, this was never the case.

How much was invested in Theranos?

Court documents show Theranos received more than $150 million from US investors. The list of possible witnesses for the trial includes media tycoon Rupert Murdoch and former US Secretary of State Henry Kissinger.

The size of the Theranos scandal has caused several investors to reassess investing in health tech. Before the trial, PitchBook, an emerging tech research company, reported that investment in healthcare technology by venture capitalists had dropped in Q2.

In Q1 2021, venture capitalists closed 153 deals valued at more than $4.3 billion versus only 92 deals valued at $3.5 billion in Q2.

This may however have been coincidental as in the first 6 months the overall investment in healthcare technology had increased compared to the same time the previous year. A mid-year healthcare investment report by Silicon Valley Bank showed that the total investment in healthcare technology in the first half of 2021 increased year-on-year.

What are 2021’s healthcare technology trends?

The COVID-19 pandemic and the need for remote access have underlined the importance of using healthcare technology.

RBC Capital research shows the near-term opportunities for healthcare technology could by 2025 reach $92 billion. The opportunities will be in digital medicine, drug research and development, disease management and diagnostics, devices, and virtual access and care.

According to CB Insights, a tech market intelligence data provider, healthcare investment globally rose for a seventh straight quarter, although the pace was slower. Funding was across close to 1,600 deals worth more than $34.7 billion.

Investors will therefore probably continue to be keenly interested in startups in the healthcare technology sector.