Are you tired of being in debt? Do you feel like you’re always struggling to make ends meet? You’re not alone. In this blog post, we will discuss some useful financial tips that can help you get your finances under control. We’ll cover everything from budgeting to investing, and we’ll provide you with some helpful resources that will make it easy for you to get started. So what are you waiting for? Read on to learn more!

Create A Budget

Create A Budget

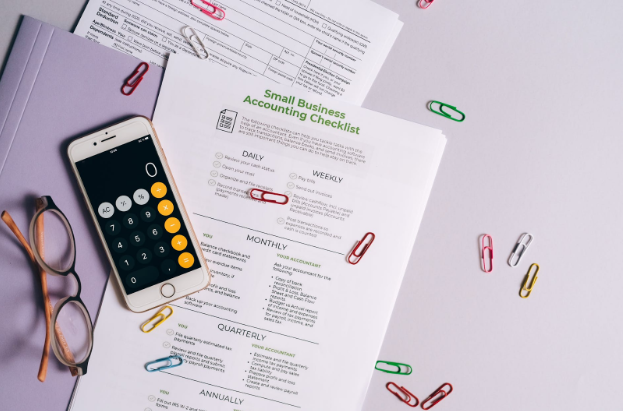

One of the most important things you can do when it comes to managing your finances is to create a budget. This may seem like a daunting task, but there are plenty of resources out there that can help you get started. You can use a budgeting app, create a spreadsheet, or even just use pen and paper. The key is to find a method that works for you and to stick to it. Once you have a budget in place, it will be much easier to track your spending and make informed decisions about financial planning. Once you have a budget in place, it will be much easier for you to track your spending and make sure that you’re not overspending.

You Can Consider SME Loans For Your Small Business

If you’re a small business owner, you may want to consider taking out an SME loan. These loans are designed specifically for small businesses, and they can be a great way to get the funding you need to grow your business. There are many different lenders out there that offer SME loans, so it’s important to shop around and find the best deal for you. You can use an online comparison tool to compare different lenders and find the one that offers the lowest interest rates and fees.

Understand Interest Rates

Interest rates are important to understand, whether you’re taking out a loan or investing your money. Interest is essentially the cost of borrowing money, and it can have a big impact on your finances. When you’re taking out a loan, you’ll want to make sure that you understand the interest rate and how it will affect your monthly payments. Similarly, when you’re investing, you’ll want to understand how interest rates can impact your investment returns. This is an important concept to understand, and it can make a big difference in your financial planning.

Start Investing

Investing is another important aspect of financial planning. When you invest, you’re essentially putting your money into something that has the potential to grow over time. This can be a great way to build your wealth and secure your financial future. Even if you don’t have a lot of money to invest, there are plenty of options out there that can help you get started. For example, you can open a brokerage account with as little as $500. Therefore, since there are many different ways to invest, it’s important to do some research and find an investment strategy that works for you.

Pay Off Your Debt

If you’re carrying any debt, it’s important to make paying it off a priority. The sooner you can get rid of your debt, the less money you’ll have to pay in interest. There are a few different strategies you can use to pay off your debt, and the best one for you will depend on your individual circumstances. For example, if you have a lot of credit card debt, you may want to focus on paying off the card with the highest interest rate first. Or, if you have student loans, you may want to consider consolidating your loans or enrolling in an income-driven repayment plan.

Save For Retirement

It’s never too early to start saving for retirement. If you don’t have a retirement savings plan in place, now is the time to start one. There are several different ways to save for retirement. One of the most popular options is to open a 401(k) account. With a 401(k), you can have money deducted from your paycheck and invested in a variety of different investments. Another option is to open an IRA account. IRAs come in two different types: traditional and Roth. With a traditional IRA, you can deduct your contributions from your taxes. The sooner you start saving, the better off you’ll be when it’s time to retire. If you’re not sure where to start, there are plenty of resources out there that can help you get started.

These are just a few of the many useful financial tips that you need to hear. If you’re serious about getting your finances under control, make sure to implement these tips into your financial planning. With a little effort and some discipline, you’ll be on your way to a bright financial future.

Create A Budget

Create A Budget