Living abroad can offer a wealth of new experiences and opportunities. Whether you are relocating for work, study, or to pursue your dreams, it is important to plan your taxes when living in a different country. Failing to do so could lead to costly penalties and fees down the road.

Fortunately, there are some simple steps you can take now that will help make sure everything is taken care of properly. This article will look at six tips on how best to manage taxes when living outside your home country.Â

Research tax laws of the host country

It is important to familiarize yourself with the taxation system in your new home country as it is likely to differ from what you’re used to. Some countries require you to submit taxes every month, while others might only need an annual submission.

For instance, if you are relocating to Germany, you will need to file your taxes annually by the end of May. It is also important to consider whether or not the host country has any double taxation treaties with your home country to avoid paying taxes twice on the same income.

Therefore, spend some time understanding the process and any potential tax break opportunities that you may be eligible for.

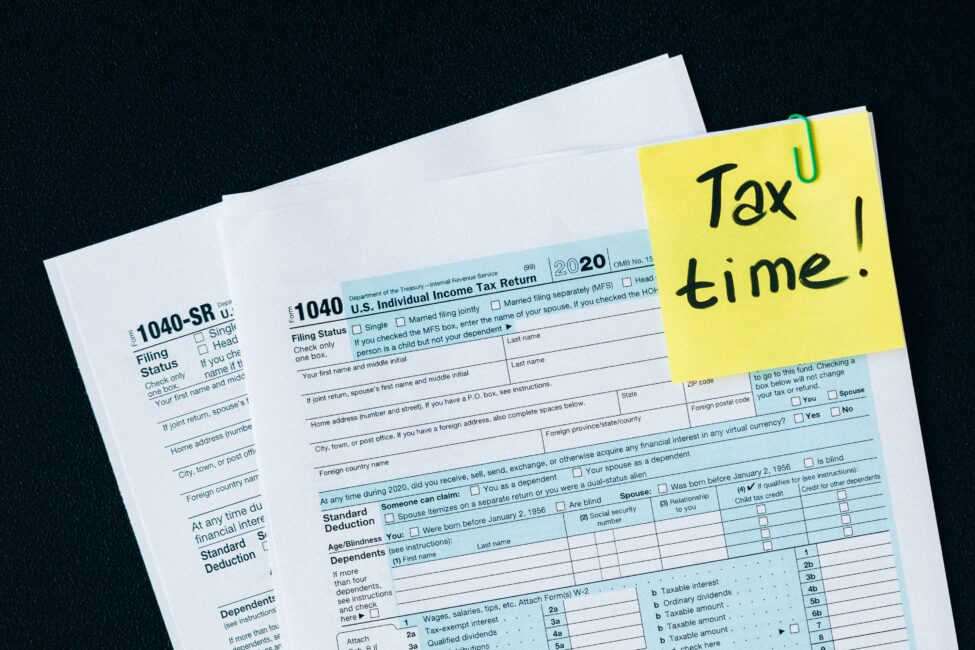

Expat taxes

If you are living abroad for more than a year, then most countries will require that you file ex-pat taxes which means filing a tax return in the country where you are currently residing as well as your home country. According to the people from 1040Abroad, if you are an American ex-pat then you must report all your worldwide income, any foreign bank or financial accounts that exceed $10,000 at any time during the tax year, and certain foreign investments. In this case, you will need to submit Form 1040 to the IRS along with any supporting documents.

On the other hand, if you are not a US citizen then it is essential to research the taxation laws of your home country and the host country to understand when and how to file taxes.

Social security contributionsÂ

Furthermore, if you are employed in a foreign country, you may be subject to its social security system which requires that you make contributions. This means that you will be required to pay social security taxes (or contributions) in the country where you are working. You should also check to see if any agreements between the country of work and your home country could impact your tax obligations in either or both countries.

Additionally, if your employer is withholding tax from your salary then you may be able to claim a credit for this in your home country.

Tax treaty benefitsÂ

Most countries have entered into tax treaties with each other, known as double taxation agreements, which can help reduce potential tax liabilities and often allow individuals to claim credits or deductions on taxes paid in one country against taxes due in another.

For instance, if you are a US citizen living and working in Germany then the income tax treaty between the two countries would help reduce or eliminate double taxation on your earnings. Of course, it is important to do your due diligence and understand the specifics of any treaty between the two countries to make sure that you are taking full advantage of tax benefits when applicable.Â

Tax filing deadlinesÂ

It is also essential to be aware of the tax filing deadlines in your host country, which will vary depending on your location. Each country has its specific requirements and regulations that you must comply with when submitting your taxes. Make sure to submit everything on time to avoid any costly penalties and fees.

Additionally, you should also take into account any tax deadlines in your home country as well, depending on whether or not you are still liable for taxes there.

Tax planning strategiesÂ

Finally, it is important to plan and keep track of all the income that you earn while living abroad to ensure that you remain compliant with the host country’s tax laws. Additionally, if you are eligible for any deductions or credits, then make sure to take advantage of them.

Tax planning also includes understanding the different tax rates in each jurisdiction and taking into account any exemptions or deductions available. This can help you make sure that you are not paying more than necessary.

From filing ex-pat taxes and understanding social security contributions to planning for tax deadlines, there are many things that you need to take into consideration when living outside your home country.

By researching double taxation agreements between countries and taking advantage of any available deductions or credits, you will be able to manage your taxes effectively while still enjoying all the benefits of an international lifestyle.

With proper planning and research, you can ensure that you remain compliant with both the host country’s regulations as well as those in your own home country.