Internal audit is a vital function within organizations that ensures the effectiveness, efficiency, and integrity of various processes, controls, and risk management systems. It is a systematic, independent, and objective evaluation of an organization’s operations, financial records, and internal control mechanisms. This comprehensive review helps organizations identify areas of improvement, mitigate risks, and enhance overall governance. Internal audit plays a critical role in enhancing transparency, compliance, and accountability within an organization.

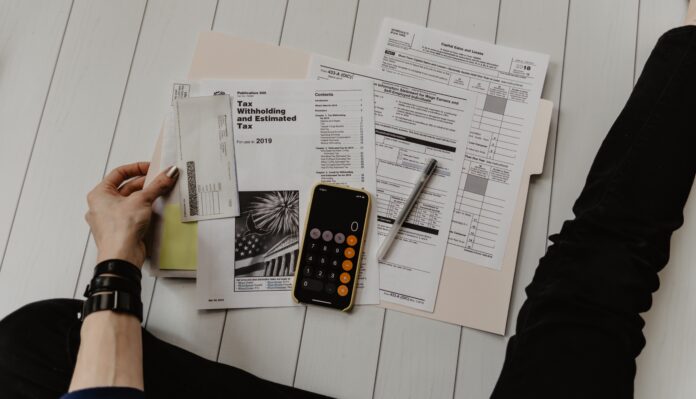

The primary purpose of internal audit is to provide assurance to management and the board of directors that the organization’s activities are conducted in accordance with applicable laws, regulations, policies, and procedures. The internal audit function operates independently from other departments and reports directly to the highest level of management. By doing so, internal auditors maintain their objectivity and independence while evaluating the organization’s operations. Here is why choose a voluntary audit that can help you get financial processes in shape before your business meets the criteria for a statutory audit.

Internal audit encompasses a wide range of activities, including evaluating the effectiveness of internal controls, assessing compliance with laws and regulations, and analyzing operational efficiencies. Auditors conduct risk assessments to identify potential threats and vulnerabilities and develop strategies to address them. They review financial statements, verify the accuracy of financial records, and assess the adequacy of accounting practices. Furthermore, internal auditors examine business processes, identify control weaknesses, and recommend improvements to enhance efficiency, reduce costs, and mitigate risks.

One of the key aspects of internal audit is the evaluation of internal controls. Internal controls are the policies, procedures, and systems established by management to safeguard assets, ensure accurate financial reporting, and promote compliance with laws and regulations. Auditors assess the design and effectiveness of these controls and provide recommendations for enhancements. By identifying control deficiencies, internal auditors help management implement stronger control measures to prevent fraud, errors, and inefficiencies.

In addition to evaluating internal controls, internal auditors also assess compliance with laws, regulations, and organizational policies. They examine whether the organization is adhering to legal and regulatory requirements, ethical standards, and internal policies. By doing so, auditors help organizations avoid legal penalties, reputational damage, and operational disruptions. They also assist in the development and implementation of compliance programs, ensuring that employees understand and adhere to the organization’s policies and procedures.

Operational audits are another critical component of internal audit. These audits focus on reviewing and evaluating the efficiency and effectiveness of an organization’s operations. Auditors analyze business processes, identify bottlenecks and inefficiencies, and recommend process improvements. By conducting operational audits, internal auditors help organizations streamline their operations, optimize resource utilization, and achieve cost savings. This, in turn, enhances the overall productivity and profitability of the organization.

Internal audit also plays a significant role in risk management. Auditors identify and assess risks across various areas of the organization, including strategic, operational, financial, and compliance risks. They develop risk management frameworks, methodologies, and processes to mitigate these risks effectively. Through risk assessments, internal auditors provide valuable insights to management and the board of directors, enabling them to make informed decisions and develop appropriate risk mitigation strategies.

Moreover, internal audit contributes to the enhancement of corporate governance. By evaluating the organization’s internal control systems, compliance mechanisms, and risk management practices, auditors provide assurance to stakeholders that the organization is operating with integrity and in their best interests. They also assess the effectiveness of the governance structure and provide recommendations for improvements. This helps organizations build trust with stakeholders, enhance their reputation, and maintain sustainable growth.

To carry out their responsibilities effectively, internal auditors follow a systematic approach. They start by planning the audit engagement, which includes defining the objectives, scope, and methodology of the audit. They gather relevant information, such as policies, procedures, and financial records, and analyze them to gain an understanding of the organization’s operations. Based on this analysis, auditors identify key risks, control points and areas requiring further examination.

The next phase involves conducting fieldwork, where auditors perform detailed testing and analysis of processes, controls, and transactions. They interview personnel, observe operations, and review supporting documentation to assess the effectiveness of controls and identify any deviations or irregularities. This rigorous examination helps auditors gather sufficient evidence to form their conclusions and recommendations.

Once the fieldwork is complete, internal auditors move on to the reporting stage. They document their findings, observations, and recommendations in a comprehensive audit report. This report is shared with management, the board of directors, and other relevant stakeholders. The report outlines the areas of improvement, control deficiencies, and potential risks identified during the audit. It also includes recommendations for corrective actions and enhancements to address these issues effectively.

The final phase of the internal audit process involves follow-up and monitoring. Auditors track the implementation of their recommendations and assess whether management has taken appropriate action to address the identified issues. They verify the effectiveness of the corrective measures and provide feedback to management on their progress. This continuous monitoring ensures that the organization’s internal control systems and risk management practices are continually improving and adapting to changing circumstances.

Internal audit is not just a reactive function that identifies problems; it also plays a proactive role in providing advisory services. Internal auditors collaborate with management to identify emerging risks, evaluate new projects, and develop strategies to mitigate potential threats. They provide insights and expertise on best practices, industry standards, and regulatory requirements. By leveraging their knowledge and expertise, internal auditors contribute to the organization’s strategic decision-making process and assist in achieving its objectives.

To perform their duties effectively, internal auditors must possess a diverse skill set. They need a solid understanding of accounting principles, financial analysis, and auditing standards. Strong analytical and problem-solving skills are essential for identifying control weaknesses, assessing risks, and developing appropriate recommendations. Excellent communication and interpersonal skills enable auditors to effectively interact with stakeholders, gather information, and present their findings in a clear and concise manner.

Internal audit also requires independence and objectivity. Auditors must maintain an impartial and unbiased perspective to provide accurate assessments and recommendations. They should be free from conflicts of interest that could compromise their judgment. Independence allows auditors to act as trusted advisors and provide reliable and unbiased information to management and the board of directors.

In conclusion, internal audit is a vital function that helps organizations ensure effective governance, risk management, and internal control systems. By conducting comprehensive reviews, auditors provide assurance that operations are conducted in compliance with laws, regulations, and internal policies. They identify control weaknesses, assess risks, and recommend enhancements to promote operational efficiency and mitigate potential threats. Through their valuable insights and recommendations, internal auditors contribute to the achievement of organizational objectives and the enhancement of stakeholder confidence.